Bridge mortgage calculator

Enter the data values separated by commas line breaks or spaces. Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided.

Bridge Loan Calculator

Our mortgage overpayment calculator uses the standard formula with fixed-rate mortgage loan.

. Bridge loan interest rates depend on your creditworthiness and the size of the loan but generally range. Enter the details of the required number of intervals and click on the. A bridge loan is a short term loan where the equity in one property is used as collateral for the bridge loan which is then used as the down payment toward a.

These come with an interest-only payment which means a borrower only has to cover monthly interest charges for the entire loan. R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. The Ultimate Mortgage Calculator calculates mortgage payment amount term down payment or interest rate creates payment plan with dates points and more.

A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of. Explore home loans and get mortgage refinancing options from Schwab. The loan is secured on the borrowers property through a process.

How to use the calculator. Your home may be repossessed if you do not keep up repayments on your mortgage. If you continuously pay an amount of on a monthly basis then you will be able to repay your mortgage off in months quicker than if you paid the regular monthly installment of.

Advanced fields include payment frequency compound frequency and payment. So when you follow through on the arithmetic you find your monthly payment. Examples of these are conventional commercial loans as well as bridge loans and hard money loans.

Based on the figures which have been entered into our Mortgage Early Repayment Calculator. 10000 00908306 45329 In this case your monthly payment for your cars loan term would be 20038. SBAs table of small business size standards helps small businesses assess their business size.

Interest rates start at the prime rate currently 325 percent and increase based on. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon. Refinancing mortgage helps in paying off an existing loan and replacing it with a new loan.

Both bridge and hard money loans are typically interest-only loans. Real estate agent commissionthe fee charged by both your real estate agent and the buyers agent typically amounts to 5-6 of the home sale price. You may not use a HELOC as a bridge loan for commercial.

R 75 per year 12 months 0625 per period 000625 on your calculator n 5 years x 12 months 60 total periods. The largest amount you could borrow. This will reduce the overall amount that you will be paying on interest for the loan reducing it from down.

You can use this grouped frequency distribution calculator to identify the class interval or width and subsequently generate a grouped frequency table to represent the data. Mortgage Rate Calculator. Some bridge loans can be as short as 6 months but most lenders offer 1 year to 3 year terms.

How to use the mortgage payment calculator. Make sure to enter your most current outstanding mortgage balance in our home sale net proceeds calculator to help determine what net cash youll receive after selling. Reading Bridge House George St Reading Berkshire RG1 8LS is authorised and regulated by the Financial Conduct Authority and is on the Financial Services Register 714187.

Additionally you only need to pay interest on your loan balance for the first 10 years. How to Qualify for Commercial Real Estate Loans. Zillow has 2367 homes for sale.

Bridge loans have a similar payment structure to traditional commercial loans though with much shorter terms. AmeriSave Mortgage Corporation headquartered in Atlanta Georgia is one of the biggest direct-to-consumer mortgage lenders in the United States of America. To use the calculator start by entering the purchase price then select an amortization period and mortgage rate.

The mortgage amount rate type fixed or variable term amortization period and payment frequency. Unlike fixed-rate mortgages adjustable-rate mortgages ARM offer mortgage interest rates typically lower than youd get with a fixed-rate mortgage for a period of. The calculator will now show you what your mortgage payments will be.

Balloon mortgages are usually associated with commercial real estate loans. If you have any trouble understanding any of the fields hover over the field for a description of the value requested. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Welcome to our commercial mortgage calculator. Monthly Mortgage Payment Rate 1 1 Rate N x Mortgage Amount. While a bridge loan allows you to buy a new home without delay it comes at a cost both in terms of interest closing fees but also the stress inherent in needing to make two mortgage payments.

A balloon mortgage has a short term that does not fully amortize but the payment is usually based on a 30-year amortization schedule. Our goal is to close your loan within 45 days of receiving your application and counseling certificateand well make. This mortgage calculator shows you.

Well get to know you your goals your home and your finances as we discuss your options. View listing photos review sales history and use our detailed real estate filters to find the perfect place. For an estimation of what your bridge loan might cost try this bridge loan calculator that lets you consider different scenarios.

After receiving an estimate from our reverse mortgage calculator you will be contacted by a Longbridge Financial loan officer. Bridge loans are similar to hard money loans though they can last up to 3 years and the interest rate tends to be slightly lower - in the 6 to 10 range. The company was founded in 2002 and offers various loan services in 49 states and in Washington DC.

However this type of financing is typically more expensive than a traditional mortgage. The calculator assumes that your monthly overpayments will be the same every month for the rest of the mortgage term. If you get a bridge loan mortgage be prepared to pay higher interest than a conventional mortgage.

The calculator shows the best rates available in your province but you can also add a different rate. Includes PMI hazard insurance property taxes and more. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term.

Here you can calculate your monthly payment total payment amount and view your amortization schedule. Use our free home mortgage calculator to estimate the cost of your new homes monthly mortgage payment.

Mortgage Calculator With Down Payment Dates And Points

Bridge Loan Calculator

Bridge Loan Calculator

Bridge Loan Calculator

What Is A Bridge Loan Mortgage Sandbox

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

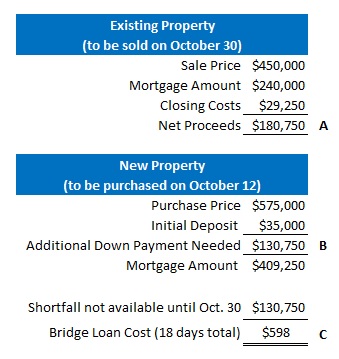

Bridge Financing A Solution When Buy And Sell Dates Don T Overlap Dave The Mortgage Broker

Bridge Loan Calculator

Utah Mortgage Calculator Nerdwallet

Mortgage Calculator How Much House Can I Afford

Calculator Bridging Loan Ifg Home Loans

How Much A 400 000 Mortgage Will Cost You Credible

Mortgage Calculator With Down Payment Dates And Points

Bridge Loan Calculator

What Is A Bridge Loan How Do They Work Bankrate

Bridge Loan Calculator

Bridge Loans And Home Purchase Bridge Loans